Ababil is a fully sharia-compliant core banking Solution, which has been perfected over two Decades through continual improvement and innovation and now currently serving several major financial institutions.

Islamic Core Banking Solution

At Millennium, we’ve revolutionized Islamic banking with Ababil NG, our new-generation Shariah-based core banking solution. Built on a Java-based microservice architecture, Ababil NG is designed to enhance consumer experience while meeting Central Bank regulations. With over two decades of industry expertise, Ababil NG addresses the unique needs and pain points of modern banks.

Islamic Agent Banking Solution

Ababil Agent Banking Module provides limited scale banking and financial services to the underserved population through engaged Agents under a valid Agency Agreement, rather than a Teller/Cashier. This Module allows cash deposit, cash withdrawal, remittance collection, and fund transfer facilities, amongst a host of other features.

Internet Banking & Mobile Application

Ababil Internet Banking & Mobile Application allows Banks to tap into a country’s unbanked population by providing mobile based financial services such as cash deposit, withdrawal, fund transfer, merchant payments, business to business, person to business payments, utility bill payments and mobile top up services. These features have been proven to be very useful for accessing the poor and rural people of a country.

Offshore Banking Solution

Ababil Offshore Banking Unit (OBU) is a specialized solution designed to meet all offshore banking requirements while seamlessly integrating with a bank’s Core Banking System. An OBU handles financial activities in currencies other than the local currency of the country where the bank is located, often providing financial and legal advantages. Ababil OBU supports key features like Usance Payment at Sight (UPAS), Multi-Currency Deposit Balance (MDB), and Qualified Foreign Currency Deposit (QFCD), offering comprehensive offshore banking services alongside the robust functionality of Ababil Islamic Core Banking Solution.

SWIFT Middleware

Ababil SWIFT Middleware Solution, designed to optimize SWIFT message management for banks. Our solution integrates seamlessly with core banking systems, automating the generation, routing, parsing, and reading of SWIFT messages. This integration eliminates the need for dual data entry, reducing costs and saving time. With features like unlimited user creation, cost-effective BIC management, and automatic message archiving, Ababil SWIFT Middleware minimizes the risk of SWIFT NAKs (Negative Acknowledgements) and helps avoid costly penalties. Experience streamlined operations and enhanced efficiency with our comprehensive middleware solution.

Islamic Microfinance Solution

Ababil Islamic Microfinance follows the Islamic Microfinance concepts to allow financial and non- financial institutions to provide economic stability to the poor. Under the Mudaraba mode of financing, this module can greatly enhance an organization’s capability to handle its Group of companies/business units/subsystems.

Trade Finance Solution

Trade finance has long been crucial for facilitating international commerce by providing banks’ financing facilities to connect merchants with domestic and global markets. Ababil enhances this process with a range of Shariah-compliant Islamic Trade Finance products. These include issuance and advising of letters of credit (L/C), handling of bills receivable, trust receipts, and banker’s acceptances. Additionally, Ababil offers export financing solutions for both pre- and post-shipment needs, with direct integration for Murabaha and Musharakah investments, as well as various banker’s guarantees like performance and tender guarantees. This comprehensive suite supports diverse trade activities while ensuring adherence to Shariah principles.

Treasury Management Solution

Ababil Treasury Management, an integral part of the Ababil Banking Solution, offers seamless integration with Core Banking, Financial Reporting, and Capital Markets. It provides comprehensive features for real- time deal capture, limit monitoring, and flexible profit calculations, along with a Maker-Checker process for transaction validation. The system supports front-office operations with individual dealer logins, real- time limit monitoring, and deal management, while the back office handles settlement instructions, trade confirmations, regulatory reporting, and SWIFT message processing. It also facilitates foreign currency dealing with automatic revaluation and various deal entries, and local currency dealing through money market transactions, Islamic bonds, and efficient Nostro fund management with automated accounting entries.

Remittance Management

Ababil Remittance Management System (RMS) is a sophisticated, integrated solution designed to streamline the handling of foreign remittances in conjunction with Core Banking Solutions. It enables banks to efficiently collect and process remittances from international exchange houses via SWIFT/EFTN, file booking, web booking, and API integrations. RMS automates transaction processing, manages remitter and beneficiary information, and supports disbursement through various channels and third- party agents. Key features include seamless multi-currency conversion, real-time data validation, configurable incentive facilities, and dynamic operational management. RMS enhances transaction speed, reduces manual effort, and provides comprehensive reporting, making it a robust solution for efficient and secure remittance management.

Real Time Gross Settlement (RTGS)

Ababil RTGS (Real-Time Gross Settlement) System offers a robust platform for the continuous, real-time processing and settlement of fund transfers. It features centralized queuing of payments pending fund availability, comprehensive monitoring of account balances for the Central Bank and participating institutions, and effective credit and intra-day liquidity management. The system ensures secure payment and message transmission through SWIFT services and supports interactive communication for monitoring and queue management. Additionally, it operates as a multi-currency system and provides a complete audit trail, recovery options, and detailed reporting facilities.

Electronic Fund Transfer Network (EFTN)

Ababil EFTN Module streamlines the electronic transmission of payments between banks, minimizing fraud risks and reducing transaction costs. Key features include management of originated EFT files, import file list generation, and electronic funds transfer capabilities during billing. The module provides detailed reports on unsuccessful credit card authorizations and NSF (Non-Sufficient Funds) checking accounts, and it validates checking and savings bank routing numbers using Automated Clearing House (ACH) rules.

SUKUK Management

Ababil-Sukuk is a comprehensive solution that enables institutions to participate in every aspect of sukuk issuance and trading. It supports full portfolio management, allowing institutions to act as investors, manage separate legal entities (SPVs), and handle subscriptions and secondary market operations. Key features include diverse profit distribution methods, flexible profit accrual options, high-performance portfolio management with real-time trade execution, and detailed dashboards providing investment status summaries. This system ensures effective and efficient management of sukuk assets while adhering to Shariah principles.

Financial Risk Management

Ababil Financing Risk Management System (AFRIMS) streamlines the entire financing process, from customer finance application to disbursement, ensuring a smooth and efficient digital journey with quick time-to-approval. Designed for flexibility, AFRIMS caters to the diverse needs of large corporates, SMEs, and retail or consumer financing. Built on a scalable platform, it allows for the creation and maintenance of financing origination workflows without the need for coding or IT support. This comprehensive solution unifies customer onboarding, financing origination, process workflows, risk assessment, decision-making, and all related financing administration.

Employee Profile Management

This module centralizes HR procedures, providing a secure platform to manage employee profiles, qualifications, and career interests. It integrates seamlessly with other modules, ensuring quick access to critical employee data.

Payroll Management

Simplifies payroll processing by consolidating HR and payroll data. It manages employee details, salary history, and benefits while improving productivity, security, and decision- making. The system also handles tax calculations and currency conversions.

Leave Management

Streamlines the leave application process, ensuring easy documentation and analysis of employee performance. It links corporate objectives to employee KPIs and tracks trends in behavior and performance.

Training Management

Centralizes training data and streamlines scheduling, tracking, and reporting of employee training programs. This module enhances visibility into training performance and helps reduce costs.

Performance Management

Facilitates the assessment of employee performance by tracking training, goal achievements, and generating insights on evaluations. It aligns corporate objectives with individual KPIs and monitors trends in performance.

Recruitment Management

Automates recruitment tasks like resume screening, shortlisting, and interview scheduling. It features a branded, multilingual e-recruitment portal and provides customizable email templates for different stages of recruitment

Attendance Management

Offers advanced attendance tracking by integrating with various devices like biometrics, smart cards, and facial recognition. It generates comprehensive reports and dashboards, reflecting the punctuality and efficiency of employees.

Sylvia Mobile Apps

The mobile app allows users to access HR information on the go, supporting modules like Leave Management, Employee Profile, and Attendance Management. Features include NFC and geofence attendance systems, leave management, and profile updates.

SYLVIA is a web-based HRMS developed by Millennium Information Solution Ltd. to optimize business operations and support enterprises in achieving their strategic and operational HR goals.

Tahqiq is a Risk-Based Internal Auditing System by Millennium, designed to manage a bank’s Internal Control & Compliance System, covering key areas like Internal Audit, Compliance, and Risk Management

Risk Based Internal Audit Management

Includes functionalities like risk-based audit planning, branch risk gradation, online audit operation and monitoring, concurrent audit, and single file management. This module would handle the entire internal audit lifecycle along with risk management.

Integration Module

Manages integration with other subsystems like HRMS and CBS, ensuring that the system can gather necessary data and interact with other departments.

Reporting Module

This could encompass the multifarious reporting capabilities, such as generating risk based internal audit reports, executive summaries, and other essential documents for stakeholders.

Authentication & Security Module

Includes multilayer authentication and the mail notification system, ensuring secure access and communication within the system.

Dashboard & Analytics Module

Incorporates the executive dashboards and dynamic search engine, providing users with data visualization and advanced search functionalities.

Calendar Management Module

Handles global and branch-specific calendar setups, ensuring that internal audit schedules align with bank and branch-specific working days.

A New Generation Islamic Banking Software Solution

Advanced Solutions for Financial Inclusion

Bringing Shariah Compliant Agent Banking Solutions Right to Your Doorstep

Ababil Agent Banking Solution has opened a new door for traditional banks by delivering Shari’ah-compliant banking services directly to the underserved population, ensuring that financial access comes to them at their doorstep.

Dedicated to alleviating poverty and sufferings of the Muslim Ummah

News & Blogs

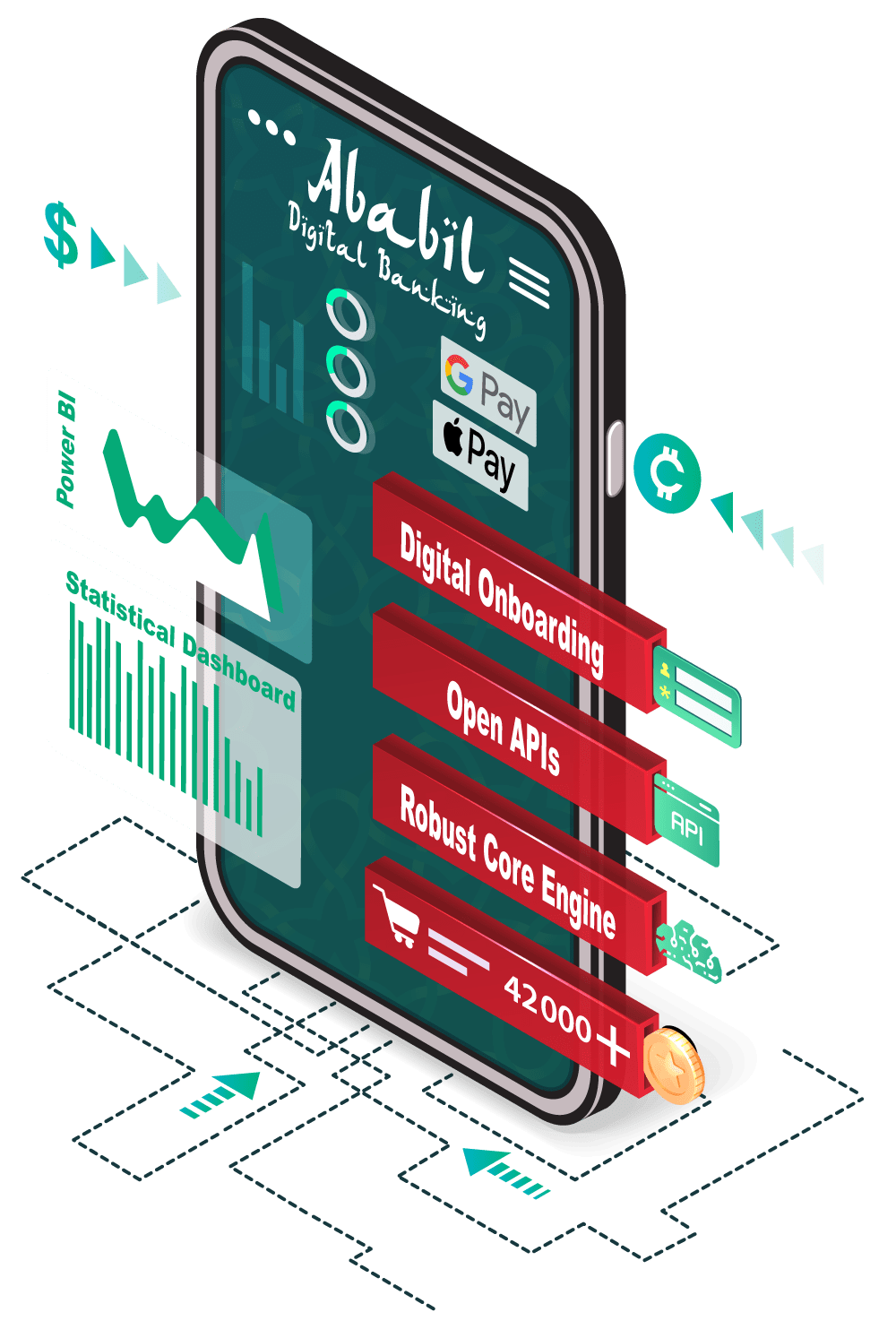

FACE THE FUTURE WITH

With Ababil Digital Banking you can have banking in your Pocket. We have created a game changing solution for Personal and seamless Digital Islamic banking experience with Ababil Digital Banking.

What we Achieve as a Software Industry

Our Footsteps

through Ababil

Agent Banking Solutions

Sylvia (HRMS)

Our Valued Clients

Our upcoming Product

Ababil Microfinance in Cloud offers a robust, Shariah-compliant solution tailored for Islamic-based NBFIs and microfinance providers. Hosted on the cloud for unmatched scalability and reliability, it features essential modules like Mudaraba Deposit and Murabaha Financing, with plans for AI-based credit scoring in future updates.

Our subscription model is affordable at just $1 per account monthly, with options for premium feature upgrades. Through seamless cloud migration, we ensure smooth transitions, empowering institutions to efficiently manage their operations and scale with ease, backed by the competitive advantage of full Shariah compliance.

What Clients Says

“We have been using Ababil for our Islamic Branch operations. The solution is integrated with our conventional Core Banking Solution. Till now, we have not faced any integration or interfacing issues related to the operations of these two solutions. Millennium Information Solution Ltd. has truly made an excellent product full of flexible features!”

Chief Information Officer

The City Bank PLC

“Flexble architecture, reliable support, and an experienced team of knowledgeable individuals who understand and respect the importance of 100% Islamic Shariah compliance – this is what makes Ababil special and a delight to use!

Head of ICT Division

Social Islami Bank PLC

“This multi-tier solution has been running successfully in our Bank for almost a decade now. The Millennium team provides excellent support to maintain the system for smooth operation of our banking services. Fast response and reliable backup helps my team to operate without any headache.”

Head of ICT DIvision

Al Arafah Islami Bank PLC

Since April 2013, we’ve successfully deployed Millennium Information Solution Ltd.’s ‘Ababil,’ a centralized Islamic Banking Solution, across our 17 branches. Its user-friendly design, supported by robust IBM X3650 server architecture, ensures optimal performance and ease of use with Google Chrome. The Millennium team’s ongoing support has been crucial for our seamless operations, affirming them as our trusted core banking solution provider

ICT Division

Union Bank PLC

Contact Us

Visit Us

- 18th Floor, Administrative Building-1, Grameen Bank Bhaban, Mirpur-2, Dhaka 1216, Bangladesh