Complete your entire Internal Audit and Compliance process, Digitally & Automated along with Risk Management Solutions

Tahqiq is a Risk Based Internal Audit System, featuring a comprehensive risk assessment module with grading which has been conceived addressing the requirements of our clientele, accounting for every action with clarity and efficiency, digitally.

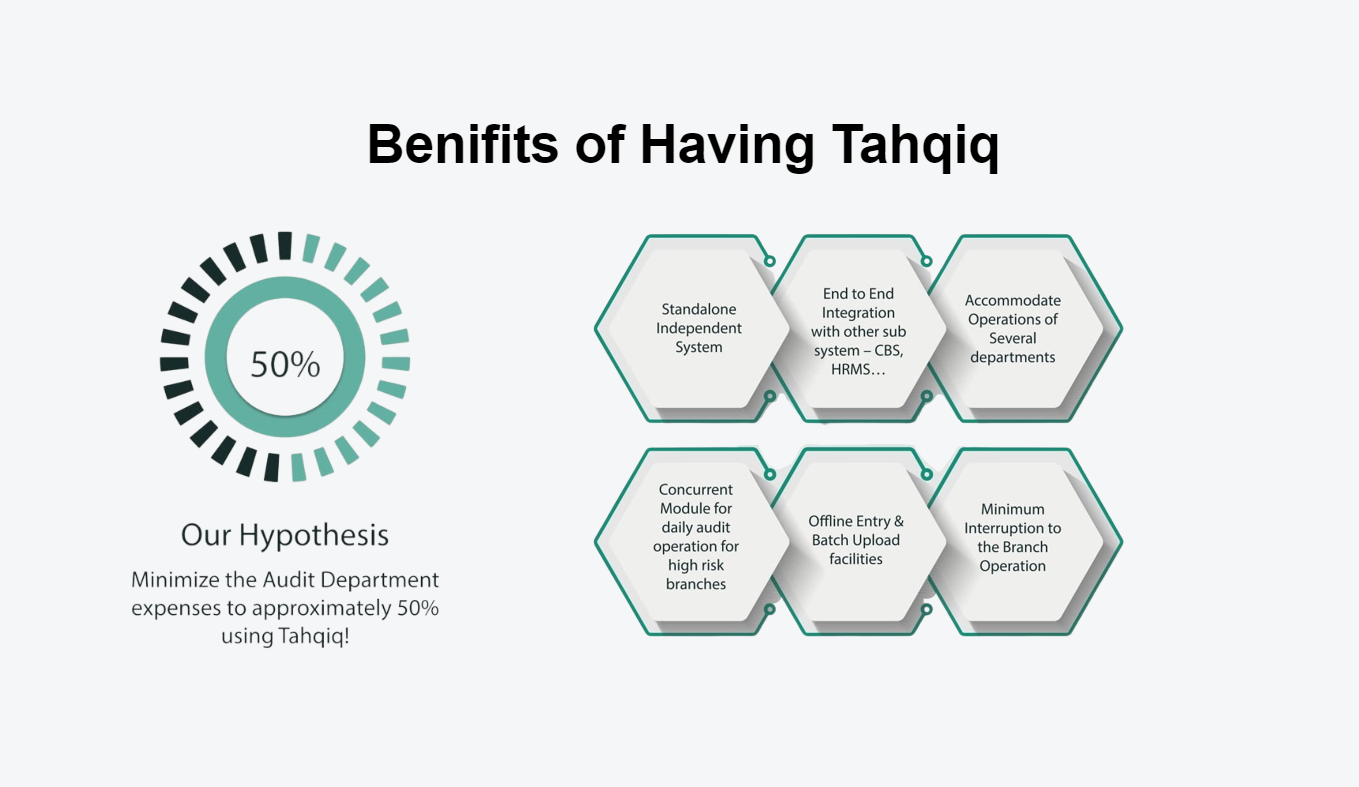

Tahqiq is a Risk-Based Internal Auditing System by Millennium, designed to manage a bank’s Internal Control & Compliance System, covering key areas like Internal Audit, Compliance, and Risk Management

Risk Based Internal Audit Management

Includes functionalities like risk-based audit planning, branch risk gradation, online audit operation and monitoring, concurrent audit, and single file management. This module would handle the entire internal audit lifecycle along with risk management.

Integration Module

Manages integration with other subsystems like HRMS and CBS, ensuring that the system can gather necessary data and interact with other departments.

Reporting Module

This could encompass the multifarious reporting capabilities, such as generating Risk Based Internal Audit reports, executive summaries, and other essential documents for stakeholders.

Authentication & Security Module

Includes multilayer authentication and the mail notification system, ensuring secure access and communication within the system.

Dashboard & Analytics Module

Incorporates the executive dashboards and dynamic search engine, providing users with data visualization and advanced search functionalities.

Calendar Management Module

Handles global and branch-specific calendar setups, ensuring that internal audit schedules align with bank and branch-specific working days.

Modules of Tahqiq

Modules

Module Title

Add Your Heading Text Here

Add Your Heading Text Here

Add Your Heading Text Here

Add Your Heading Text Here

Tahqiq Salient Features

01

Audit Workflow Automation

Automated workflows that enhance the speed and accuracy of internal audit operations along with risk management, reducing manual efforts.

02

Comprehensive Reporting

Provides comprehensive reporting capabilities that allow auditors to generate detailed insights and analysis.

03

Cost Reduction

Reduces overall departmental expenses by streamlining the internal audit processes, optimizing resource usage and addressing risk factors through our risk management.

04

Risk Grading

Features advanced risk grading systems to effectively assess and categorize risks based on severity and impact.

05

Statistical Decision Dashboard

Offers decision-makers a powerful dashboard with statistical data to support informed decision-making processes.

06

Risk Based Internal Audit Automation

Enhances internal audit coverage through automation along with risk management, also improving time management and overall operational efficiency.

Important And Handy Reports

This is the detailed report of auditor's observations along with its related officials along with risk factors addressed, severity of the observations, recommendations and branch feedback with its mitigation status.

This is the Board Audit Committee Repo"

generated to be placed the aoard with the

contents of Major Irregularities (VSI„ DVSL

& SLI On General Banking,lnvestment

Foreign Exchange Foreign Trade Portfolio

detected by the Auditors Wilh its updated

Branch Compliances.

This is the summary of The Main Audit Report

Contents of this report are the Business Position of the branch consisting of yearly comparison of Target & Achievement, Deposit Mix, Investment Position, Import, Export, Remittance, etc.

In case of auditor’s disagreement to

the observations resolved by

compliance users are reported as

False Compliance Statement.

This is the branch risk gradation report processing business risk data from CBS, control risk data-based on internal audit observation and core risk element data defined by Central Bank.

Customized Report

The dynamic search engine is an integral part of the system to explore any sort of reports and searching observations in a 360-degree view.

Automatic Risk Grading

Through years of hard work in research and development with banking software, Tahqiq brings in the market a game changing product for the banking industry which help banks to perform automatic Risk Grading for the branches, eventually bank as a whole, based on its business performance from CBS data and internal audit observation on the exposure to the Central Bank defined Core Risk Areas.

Branch 3 Risk Grading

- Business Risk Score Derived From Data Fetched From CBS

- Control Risk Based On Audit Observation

- Control Risk Central Bank Defined Core Risk Areas

Oparational Workflow

Check Your Bank's Health

Ababil is Certified by ISRA

Tahqiq's Clients

Our upcoming Product

What we Achieve as a Software Industry